Global sharemarkets were under pressure, with a lot of volatility this week. Good news on economic data was somewhat bad news for markets early in the week. Signs of a stronger US economy questioned market pricing of ~3 Fed rate cuts by end-2024 which also lifted bond yields, although this was somewhat tempered by Fed Chair Powell’s comments around the high odds of cuts later this year and the strong US employment report was seen as positive for the US economy. Geopolitical tensions heightened after Israel said it would operate against Iran and its proxies and signs of weakening US support for Israel after an Israeli strike on aid workers. The oil price rose to ~$87/barrel as a result, its highest level since October 2023, because Iranian involvement in the war could disrupt oil supplies (Iran is a top 10 global producer of oil). Higher oil prices can be a disruption for global growth and are inflationary so sharemarkets responded negatively to this news. US shares are down by 1% over the week, with the only sectors bucking the trend being energy and communication services. Eurozone shares fell by 1.3%, Australian shares fell by 0.6% with only energy and utilities up and Japanese equities were also down while Chinese shares managed to rise. Bond yields rose over the week with the US 10-year above 4.4%, its highest level since November 2023. The US dollar was basically flat and the $A was a tad higher at 0.658 USD. Equity markets have had a strong run-up since the beginning of the year, so some degree of a pullback is expected, given the long list of downside risks. We have a positive view on equities over 2024 as we expect inflation to slow and growth to hold up, but moderate falls in sharemarkets are unavoidable given that interest rates are still high compared to recent years, growth could dip lower and multiple geopolitical risk evets on the calendar.

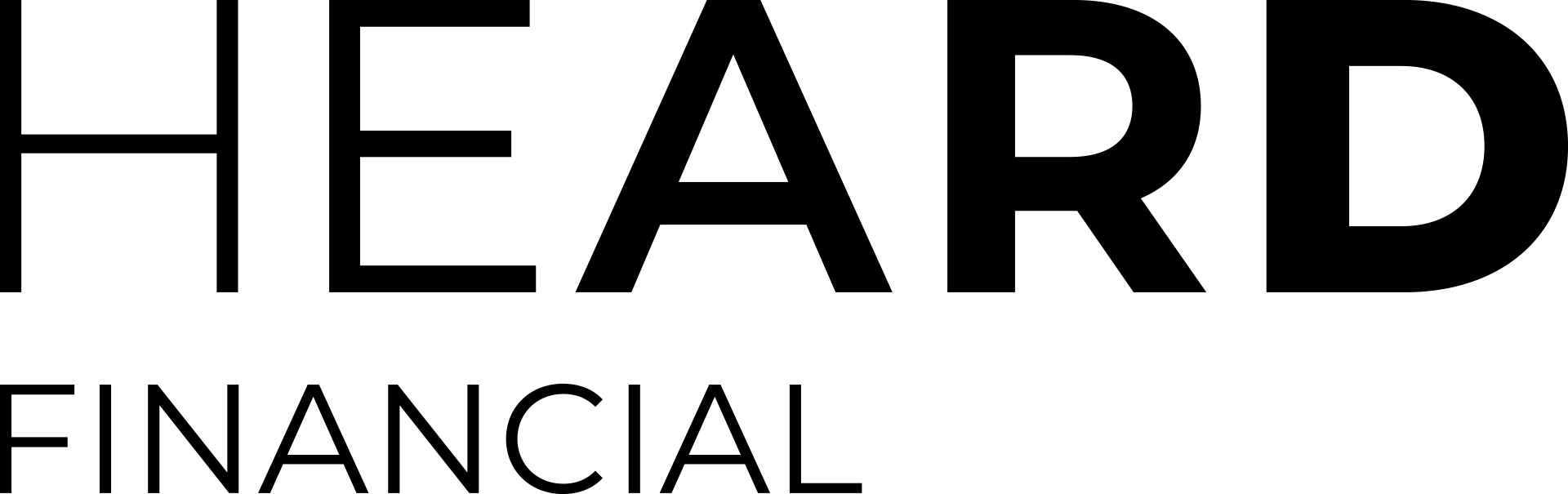

Metal prices are rallying. Gold prices rose to another record high (see the next below).

Source: Macrobond, AMP

Some commentators are saying the signal from gold is the markets interpretation that the Fed will cut interest rates which is positive for gold prices because income-yielding assets like bonds are generally seen to be less attractive in a falling interest rate environment. The rise in gold prices could also be a geopolitical signal, as investors use gold as a safe haven. Copper prices are also rising strongly, a signal that has typically been associated with better global growth outcomes.

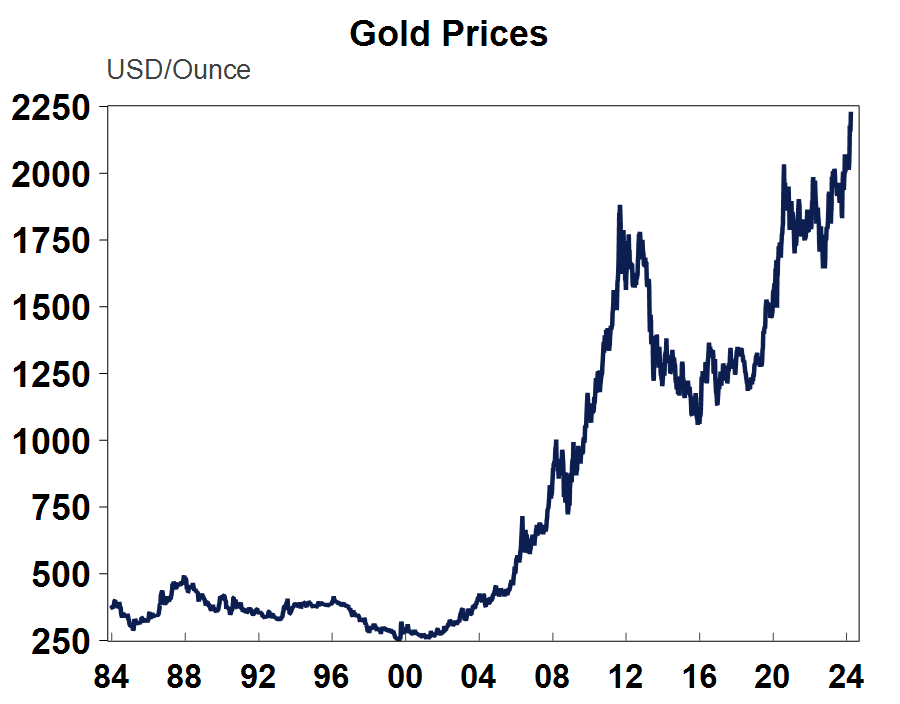

Taiwan’s strongest earthquake in 25 years has had a large number of injuries and some deaths as well as aftershocks in nearby countries like Japan and China and is a reminder of the unexpected and horrible impact of natural disasters. The impact on financial markets from natural disasters is initially about the disruption to the economy which in the case of Taiwan so far looks small. Taiwan’s main exports are semiconductors, worth around 35% of total exports (see the chart below) which have not been impacted according to media reports.

Source: Macrobond, AMP

Major global economic events and implications

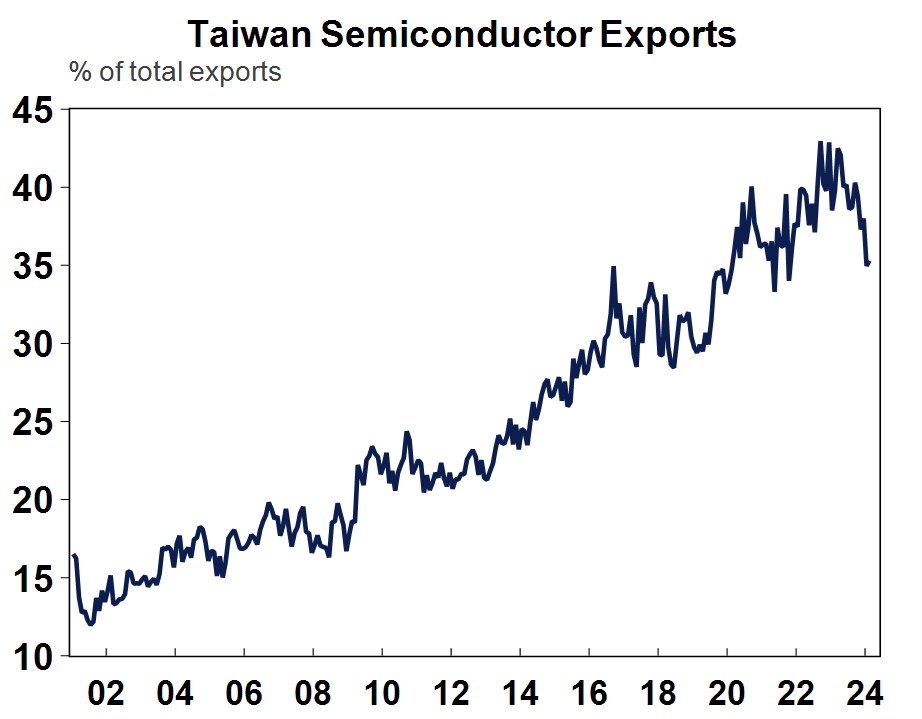

US data was mixed. February factor orders rose by 1.4%, stronger than expected. The ISM manufacturing index for March rose more than expected to 50.3 (from 47.8 last month) indicating that manufacturing activity is expanding again, for the first time since October 2022. The prices paid component also lifted. The manufacturing PMI has also been increasing (see the chart below).

Source: Bloomberg, AMP

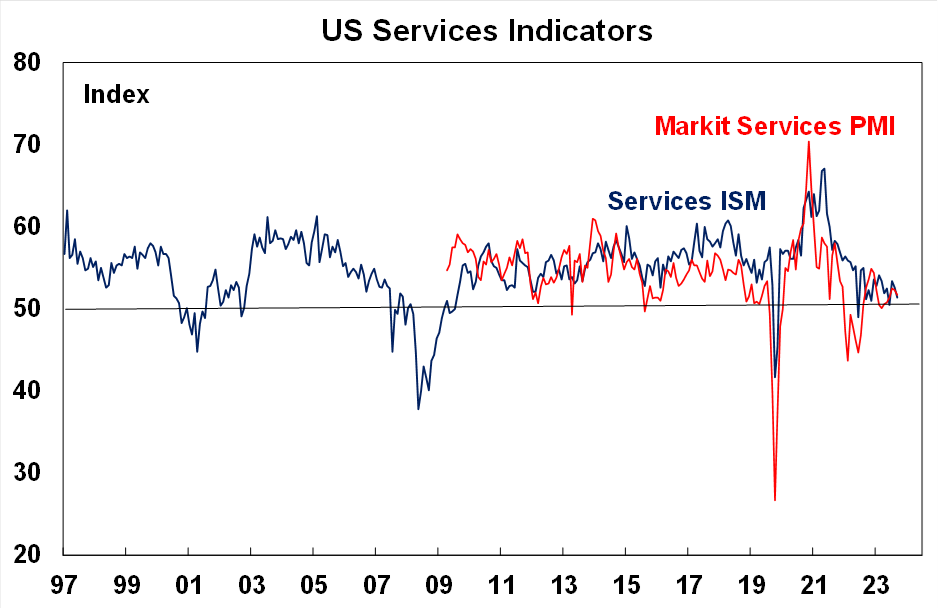

In contrast, the ISM services index was down to 51.4 in March (from 52.6 last month), lower than expected and prices paid also fell to its lowest level since 2020. The Markit services index has moved in a similar pattern (see the chart below).

Source: Bloomberg, AMP

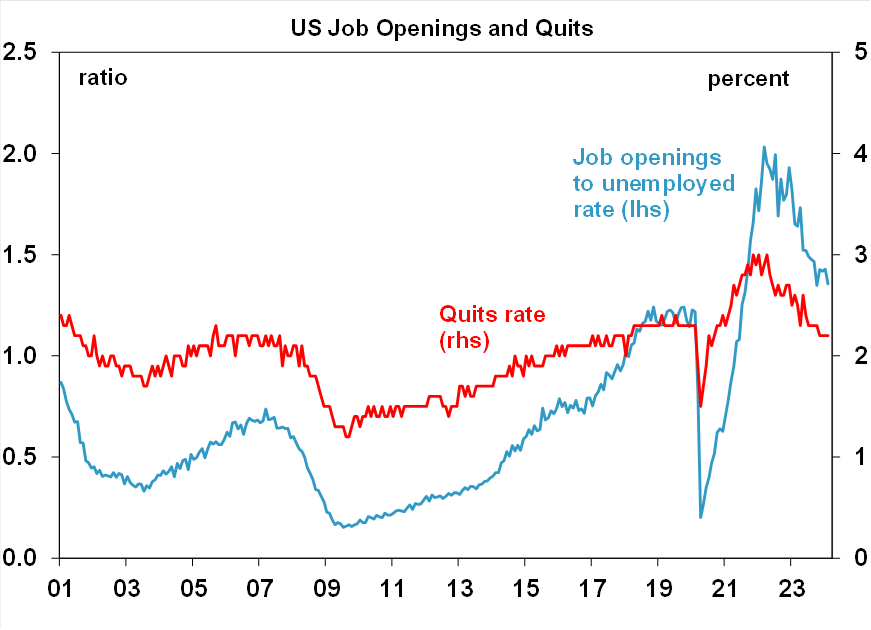

US job openings edged up slightly in February (consensus was looking for a slight fall) but the better indicator of spare capacity in the labour market is the ratio of job openings to unemployed, which fell slightly to 1.36 (from 1.43 last month) but is still high relative to history. The quits rate, another indicator of labour market tightness remained at 2.2%, and has fallen back to pre pandemic levels (see the chart below).

Source: Bloomberg, AMP

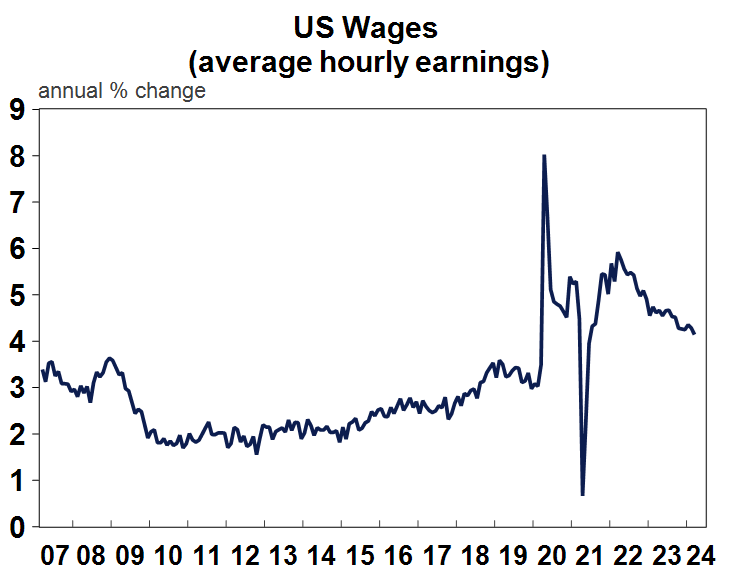

The March non-farm payrolls report was much stronger than expected. Non-farm payrolls rose by 303K over the month (consensus at 214K) and revisions saw additional jobs added to the two prior months. The unemployment rate dropped to 3.8% (as expected), the participation rate was stronger than expected at 62.7% with the underemployment rate flat at 7.3%. Average hourly earnings rose by 0.3% over the month of 4.1% over the year, a slowing from its highs but is still higher than the Fed would like (see the chart below). The labour market appears to be strengthening and not slowing, despite the weakening in leading indicators which could see a delay to interest rate cuts.

Source: Macrobond, AMP

US Fed Chair Powell spoke this week and sounded dovish, despite the stronger data on jobs and inflation recently, reiterating his expectation that the Fed will begin lowering rates “at some point this year” and that more confidence around the inflation outlook was still needed before the Fed started cutting rates. Some of Powell’s colleagues including Kashkari said rate cuts may not be needed this year if progress on inflation stalls. While Mester said that central bank is getting close to the level of confidence it needs to start lowering rates in the next few months. And Harker said that inflation was still “too high”. So clearly, there are a wide range of opinions at the Fed which increases the possibilities of outcomes for interest rates and means that key data points like inflation and employment are critical to watch.

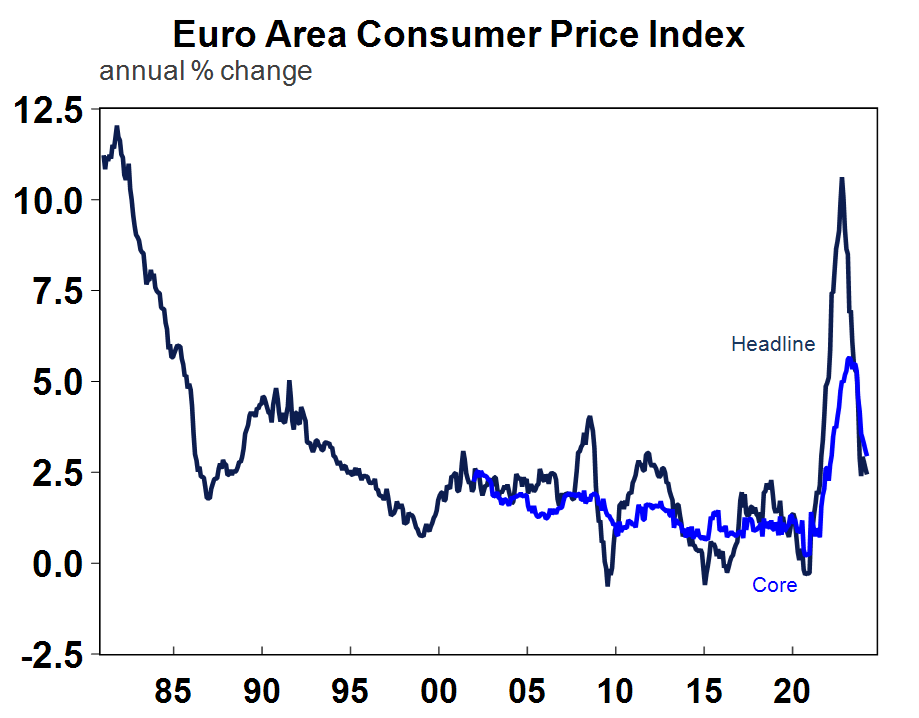

March Eurozone consumer prices rose by 0.8% over the month (2.4% over the year) or 2.9% year on year on core measures, all a touch lower than expected (see the chart below). Highest inflation is in Croatia, Austria and Estonia while the lowest is in Lithuania, Finland, Latvia and Italy. The sharp slowing in Eurozone inflation and poor economic growth will give the ECB room to start cutting interest rates, probably before the US Fed.

Source: Macrobond, AMP

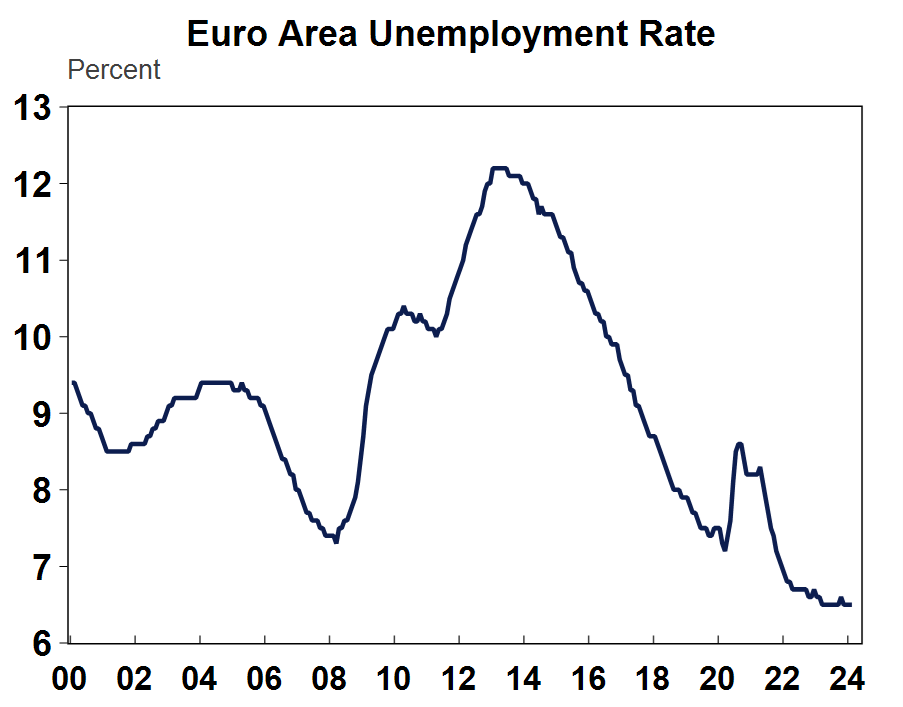

The Eurozone unemployment rate was unchanged at 6.5%, still around its post-pandemic low.

Source: Macrobond, AMP

Australian economic events and implications

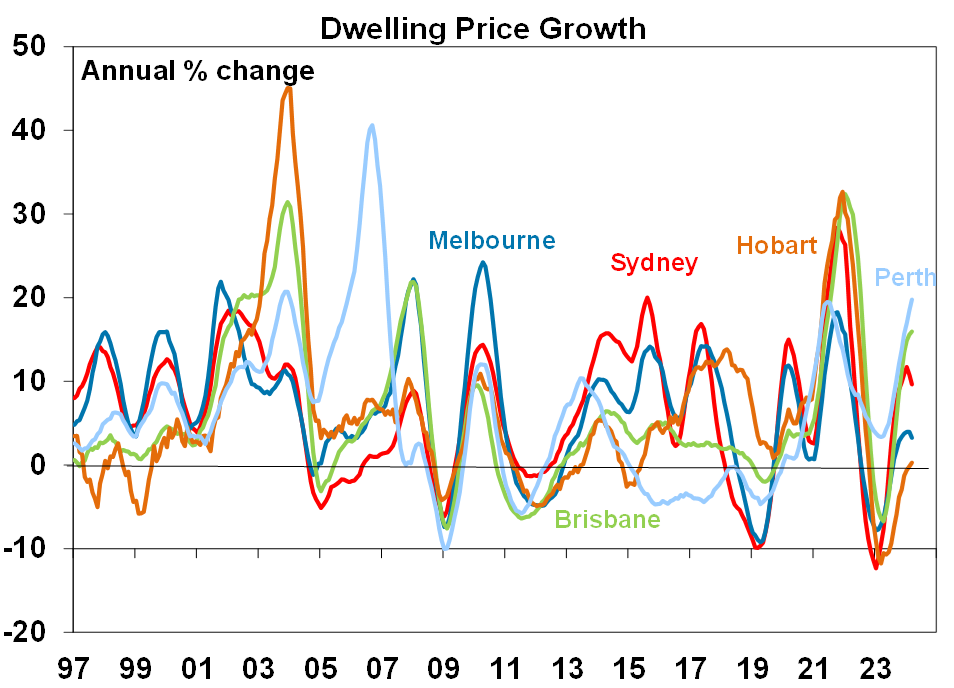

CoreLogic home prices rose by 0.6% in March across the capital cities and annual growth was up by 8.8%. Every capital city except for Darwin recorded an increase in dwelling values in March but there are divergences across states and territories. Perth, Adelaide and Brisbane had the highest pace of growth and have had strong returns over the past year and dwelling prices in these capital cities are at a record high while home price growth in Darwin, Hobart and Canberra was softer and home values are still some way away from their record levels. Melbourne price growth has been low in the last quarter while Sydney has been stronger and dwelling values are close to record highs. Out of interest, the median value of a home in Sydney is the highest at $1,139,75 and the lowest in Darwin at $498,433.

Source: CoreLogic, AMP

ANZ job advertisements fell by 1% in March and are down by 10.6% over the year, but still 32.1% higher than pre-pandemic which indicates ongoing spare capacity in the labour market.

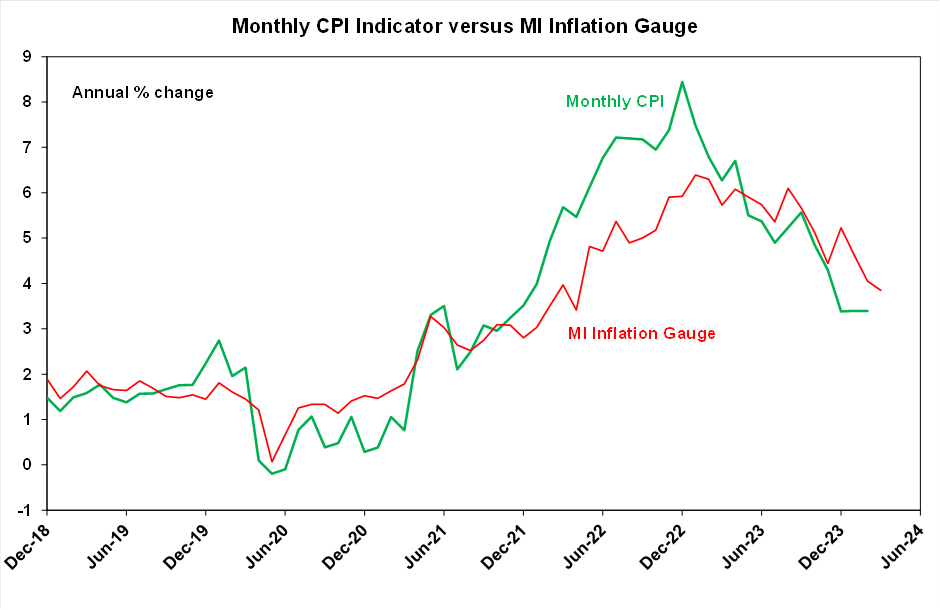

The Melbourne Institute inflation gauge rose by 0.1% over March, to be 3.8% higher over the year, continuing to show a slowing in inflation.

Source: Bloomberg, AMP

RBA Meeting minutes for the March board meeting didn’t contain much new information given that the RBA now holds a post-meeting press conference where the Governor can elaborate on specifics. The minutes again mentioned the neutral policy bias that “it was difficult to either rule in or out future changes in the cash rate target”, the same language used by Governor Bullock in the post-meeting statement and press conference. But the last sentence in the minutes sounded slightly more hawkish as it noted that the Board would “do what is necessary” to return inflation to target, in contrast to the post-meeting statement which noted that the Board was “resolute” in its determination to return inflation to target. It’s only a slight change in tone but the RBA doesn’t appear to be in a rush to cut interest rates just yet.

RBA Assistant Governor Kent spoke about the RBA’s new system for implementing monetary policy. This has nothing to do about the level of the cash rate, but the method that the RBA undertakes to control the cash rate via the Exchange Settlement balances that banks hold with the RBA. It gets very technical but basically the RBA’s balance sheet is running down as its QE purchases mature so the RBA is moving to an “ample reserves system” with full allotment repurchase agreement auctions for open market operations, similar to the BoE the ECB and Swedish Riksbank. Prior to the pandemic, the RBA used the interest rate corridor with scarce resources to implement monetary policy and used open market operations. As Governor Kent said this is a change to the “plumbing” of how monetary policy works.

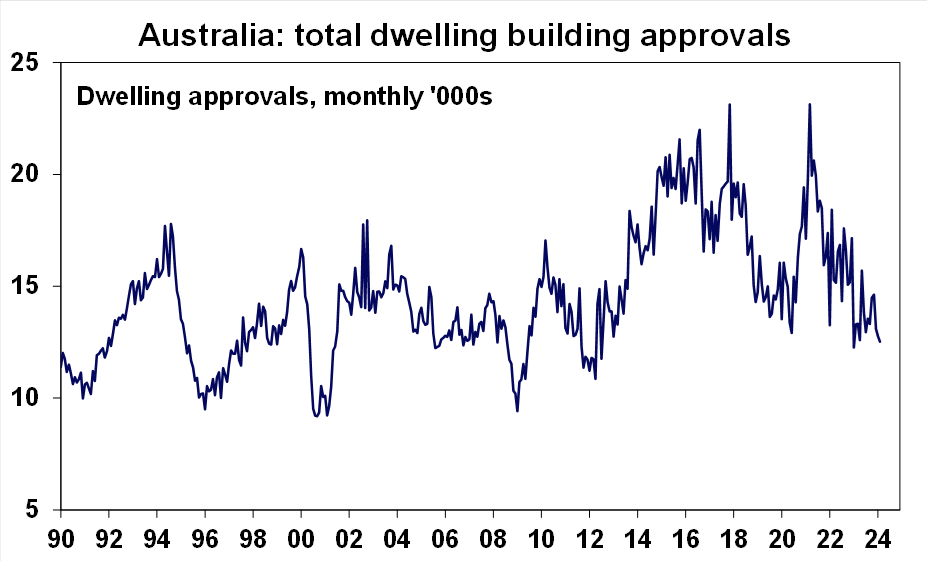

February building approvals disappointed expectations, falling by 1.9% but houses were stronger (+10.5%) while non-detached dwellings fell by 20.8%. Building approvals are down by 5.8% over the year and in the past year building approvals are running at 162.8K – well above the ~220K needed to be built every year to keep up with population growth which is a problem because it means that the issue of housing undersupply is not getting better.

Source: ABS, AMP

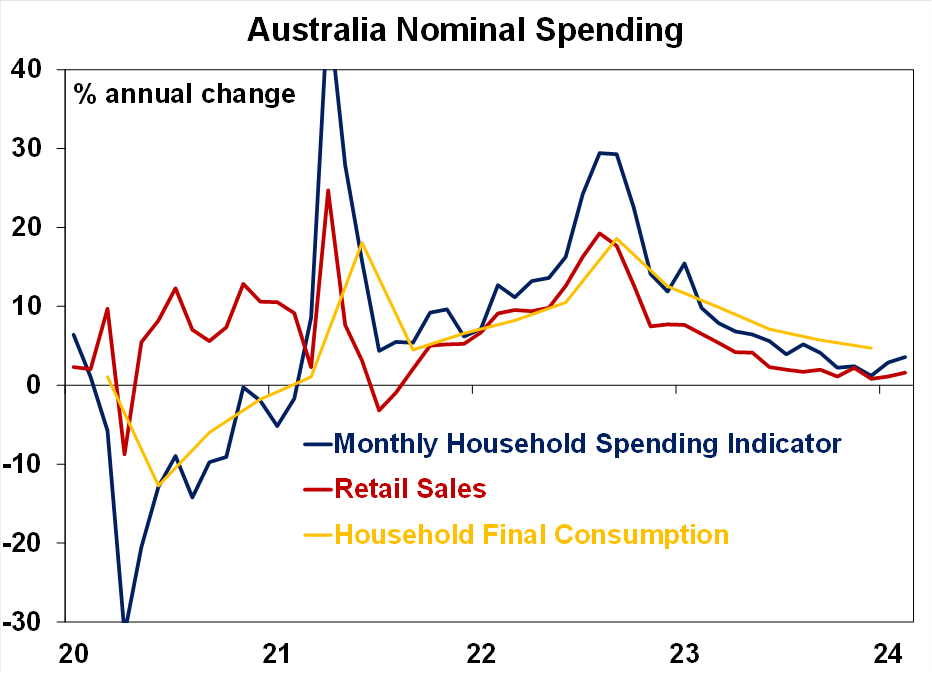

The February Household Spending Indicator rose by 3.6% over the year to February, the strongest pace of growth since September 2023 and indicates some recovery in consumer spending. This indicator is eventually going to replace the retail release because it includes a broader range of spending categories, mostly for services, so it is worthwhile to look at.

Source: ABS, AMP

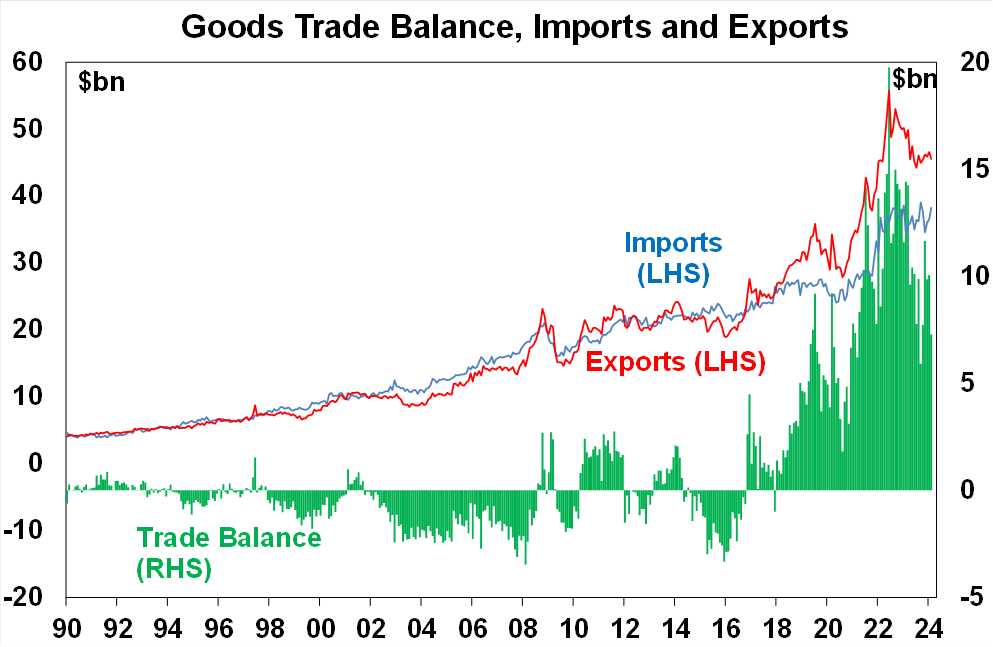

The February balance on goods surplus declined to $7.3bn, as exports fell due to a decline in iron ore and imports rose (see the next chart) driven by industrial supplies. Despite the fall in February, the goods trade balance surplus is much larger in recent years compared to history.

Source: Bloomberg, AMP

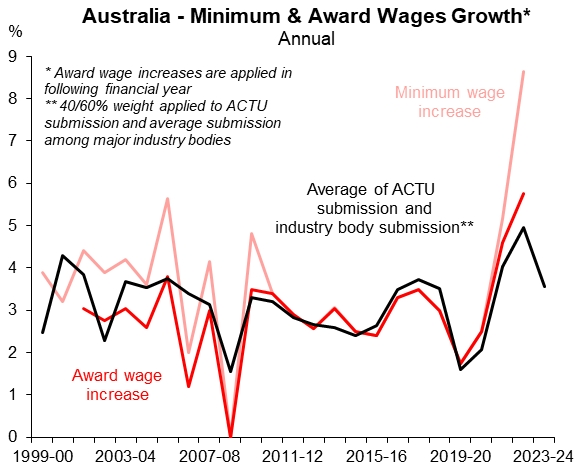

This interesting chart from Macquarie looks at recent submissions for the minimum and award wage decision (which will be finalised in June). It shows that submissions from major industry bodies and the Australian Council of Trade Unions is tracking around 3.6% and is usually a good guide to the actual outcome. An increase to minimum and award wages around this level is still high (and above the current rate of inflation), as more sustainable levels of wages growth in line with the RBA’s inflation target are more around the 3% level, but is less than was awarded last year and would be in line with our and the RBA forecasts of slowing wages growth.

Source: Macquarie, AMP

What to watch over the next week?

US March quarter reporting season begins next week with some banks reporting earnings. Earnings growth is likely to be around 4-5% over the year, down from previous forecasts of 9 10%. The March consumer price data (next Wednesday) should show a further moderation in price growth, with a 0.3% lift in prices over the month, taking annual growth to 3.5% with core inflation at 3.7% over the year. Other indicators to watch include the NFIB small business optimism index, FOMC meeting minutes, the monthly budget figures, producer prices (expected to increase by 0.3% over March, around half of its lift in the prior month), import prices for March and the University of Michigan consumer sentiment and inflation expectations index.

In Australia, housing finance figures should a rebound of 2% for new housing loans financed in February, after a fall in the prior month. April consumer sentiment will probably remain around its lows and the March NAB business survey should show lower-than-average business confidence and some slowing in business conditions.

The Reserve Bank of New Zealand meets on Wednesday and the Overnight Cash Rate is expected to be held at 5.5%, but a dovish tilt is likely in the post-meeting statement given the confirmation of a technical recession in the second half of 2023 and other signs of financial stress, including rising arrears rates.

The European Central Bank meets next week and no change to interest rates is expected but any change to forward guidance will be important. The minutes from the March ECB meeting indicates that the Governing Council saw a first cut in June, followed by 2-3 more cuts. Markets are pricing in a high probability of a June rate cut. The faster slowing in Eurozone inflation and weak growth outcomes certainly give the ECB room to start easing interest rates.

The Bank of Canada also meet next week and similar to the ECB are unlikely to cut interest rates just yet but are certainly inching closer towards monetary easing so watch for any changes to language in their post-meeting statement.

In China, updates on credit growth for March are released. March producer prices are likely to show continued deflation while consumer price growth is expected to be higher, at around 0.4% year on year.

Outlook for investment markets

Easing inflation pressures, central banks moving to cut rates and prospects for stronger growth in 2025 should make for good investment returns this year. However, with a high risk of recession and investors and share market valuations no longer positioned for recession and geopolitical risks, it’s likely to be a rougher and more constrained ride than in 2023.

We expect the ASX 200 to return 9% this year and rise to around 7900. This is now looking conservative. A recession is probably the main threat.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows, and central banks cut rates.

Unlisted commercial property returns are likely to be negative again due to the lagged impact of high bond yields & working from home.

Australian home prices are likely to see more constrained gains compared to 2023 as still high interest rates constrain demand and unemployment rises. The supply shortfall should provide support though and rate cuts from mid-year should help boost price growth later in the year.

Cash and bank deposits are expected to provide returns of over 4%, reflecting the back up in interest rates.

A rising trend in the $A is likely taking it to $US0.72, due to a fall in the overvalued $US & the Fed cutting rates by more than the RBA.

What you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.